Best ETFs in the Philippines

How We Picked

Liquidity

We considered the liquidity or availability of liquid assets and individual securities to be traded in each ETF’s portfolio.

Trading Activity

We looked into the volume of units being exchanged, delivered, or sold in a trade for each ETF on a daily basis.

Management Cost

We considered how much each ETF would charge for management costs and brokerage fees.

Investment Risk

Finally, we assessed the risk of investing in each ETF and gave higher ratings for the ones that posed the least risk.

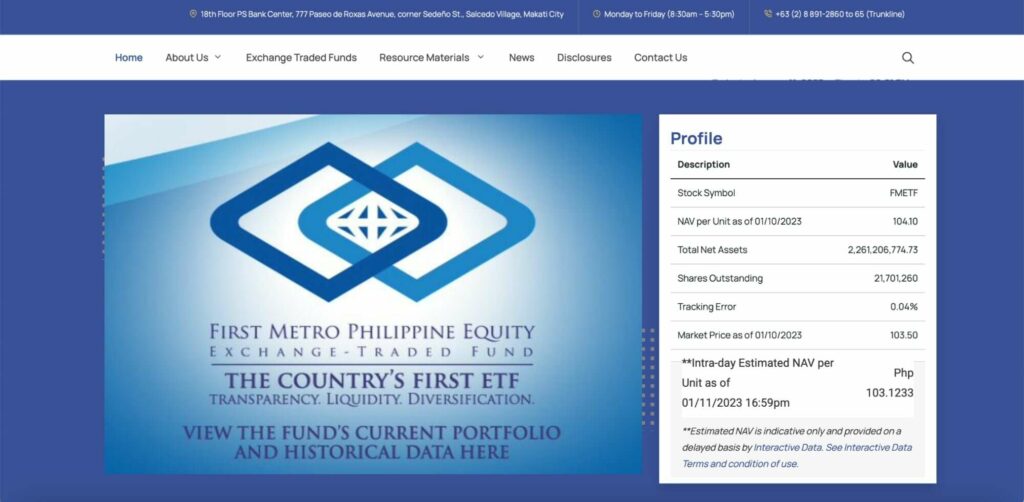

1. First Metro Exchange Traded Fund (FMETF)

Stock Symbol: FMETF

| Liquidity | 3/5 |

| Trading Activity | 4/5 |

| Management Cost | 4/5 |

| Investment Risk | 5/5 |

Pros

- Lowest fees among local investment funds

- Transparent stock price

- Not very risky – returns are roughly the market average

Cons

- Low liquidity

- Not very diversified

The First Metro Philippine Equity Exchange-Traded Fund or FMETF enjoys the recognition of being the first ETF in the Philippine market since its establishment in 2013.

FMETF is an equities index fund that reflects the performance of the Philippine Stock Exchange Index or PSEi. These are the top 30 companies in the Philippines worth investing in.

Its fund manager is First Metro Investment Corporation, which is a subsidiary of the Metrobank Group.

In terms of risk, you won’t feel the brunt of specific businesses going down because with FMETF, you’ll have your assets distributed across a variety of industries.

Your returns are roughly the market average, so your investments will perform well if most of the stocks in the PSEi are performing well too.

The best thing about investing in FMETF is that it charges the lowest management fees among local investment funds. The fund manager from FMETF would only charge a 0.05% management fee of the total net asset value per share or NAVPS of each stock.

This is already impressive In comparison to UITF management fees which could range from 0.05% to 1.5% of the share price.

Another thing we love about FMETF is that they disclose their assets, and are ultimately very transparent with their stock prices. You can access all the information you need at a glance on their website.

Since ETFs are not quite as popular investments in the Philippines as UITFs and VULs, one of the downsides of investing in FMETF is its liquidity. You’ll either have difficulty exiting an investment or will have to cut your losses.

Another limitation of FMETF is that its portfolio is not very diversified. Almost half of it consists of stocks from 4 major corporations, and covers more of real estate and financials than other industries like communications, technology and manufacturing.

2. Invesco QQQ ETF (QQQ)

Stock Symbol: QQQ

| Liquidity | 5/5 |

| Trading Activity | 5/5 |

| Management Cost | 5/5 |

| Investment Risk | 2.5/5 |

Pros

- Promising to invest in tech industry

- Great potential for long-term growth

- High liquidity

- Cheap fees

Cons

- Loses money quickly if tech industry suffers

- Stocks are overvalued

- Portfolio not diversified

Invesco QQQ is an exchange-traded fund which reflects the performance of NASDAQ-100. It is run by Invesco Capital Management LLC.

QQQ is a US-based ETF, but it gives opportunities for Filipinos and other foreign traders to invest in the American market. Most of the companies in Invesco’s portfolio are in the technology sector, which is very promising to invest in at this day and age.

Among the top holdings of QQQ are Apple, Microsoft, NVDIA, Amazon, and Meta, which was formerly Facebook.

What we love about Invesco following the NASDAQ index is that it offers great potential for long-term growth for your investment, because everyone acknowledges across the board that the future is tech.

We also recommend Invesco QQQ because of its high liquidity. Traders are buying and selling their stocks on the daily, and their monthly average dollar volume goes up to $17 Billion USD.

Another great thing about it is its cheap fees. Invesco’s expense ratio is as little as 0.2 % a year.

The downside to investing in Invesco QQQ is that if the tech industry suffers, you’ll find yourself losing money quickly.

The tech sector is reputed to have the most volatile stocks among various industries, so it’s something worth considering if you have a low risk appetite.

Another criticism we have against QQQ is that its stocks are overvalued. Its holdings are priced rather expensively, and being caught in a value trap is dangerous because you could incur losses when the price eventually drops.

You can invest in QQQ through popular trading platforms like eToro, Interactive Brokers, and Fidelity among others.

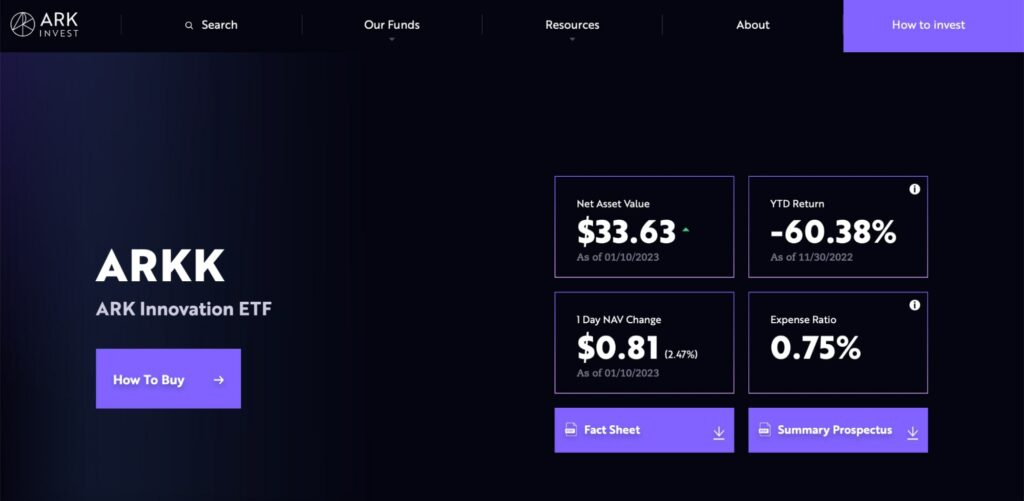

3. ARK Innovation ETF (ARKK)

Stock Symbol: ARKK

| Liquidity | 4/5 |

| Trading Activity | 4/5 |

| Management Cost | 5/5 |

| Investment Risk | 1/5 |

Pros

- Promising actively-managed ETF

- Looking for the next big thing

- Larger profits within the horizon

- Enjoys upward trend, growing cashflow

Cons

- Not recommended for short-term traders

- Holdings are extremely volatile

If you’re familiar with the term “disruptive innovation”, you won’t have trouble understanding the business model ARK Innovation ETF is built upon.

ARKK is an actively-managed ETF, which means that instead of tracking a specific index, it tracks a mutual fund, or even more specifically, top picks of the fund manager.

ARK Innovation’s New York-based fund managers do their research and focus their money on companies that they believe are on the brink of groundbreaking advancements in the fields of science and technology.

They veer away from blue chip companies and traditional businesses, and look for the next big thing. We see the merit in this philosophy, because when you invest in up and coming companies no one really knows about yet, larger profits are within the horizon.

We went over their holdings which include companies into robotics, tech manufacturing, medical technology, artificial intelligence, among others. These fields are steadily growing, and so is ARKK’s cashflow.

The drawback to investing with ARKK is that its maximum potential returns happen far down the line. We wouldn’t recommend it for short-term traders, who wait for sudden spikes and strike when the iron is hot.

It is also more high risk, with its holdings being extremely volatile. Historically, there are years where its profits dip down to the negatives, then the following year, it skyrockets.

Ultimately, investing in an ETF like ARKK will chiefly depend on your risk threshold.

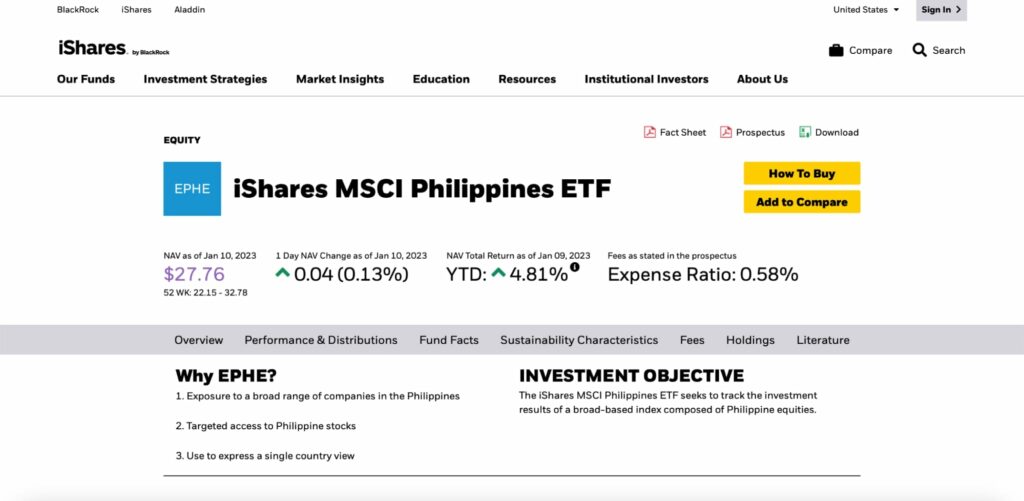

4. iShares MSCI Philippines ETF (EPHE)

Stock Symbol: EPHE

| Liquidity | 5/5 |

| Trading Activity | 4/5 |

| Management Cost | 2.5/5 |

| Investment Risk | 4/5 |

Pros

- MSCI one of the biggest ETF providers in the world

- These are the stocks that most foreign investors hold in the PH

- More liquid than the PSEi or FMETF

Cons

- Recent returns below benchmark

- High expense ratio

MSCI is known as a global giant in financial analytics and investment research, and iShares also among the world’s biggest ETF providers.

If you want to trade local stocks with international investors in an exchange-traded fund, we recommend putting your money in EPHE.

EPHE or iShares MSCI Philippines ETF, which is a subsidiary of the investment company BlackRock, tracks the investment of a wide range of Philippine equities from large to mid-cap stocks.

Its portfolio includes consumer products, telcos, and real estate. Their top holdings include SM Prime Holdings, BDO Unibank, Ayala Land, SM Investments, and Ayala Corporation among others.

EPHE is representative of most of the blue-chip companies in the PSEi. However, these stocks are the ones that most foreign investors hold in the Philippines because they are listed in US stock exchanges and it’s easier to trade through MSCI.

Another thing we like about EPHE is that its assets are more liquid than other local ETFs, which makes daily trading and exiting holdings a whole lot easier.

What would discourage us from investing with MSCI is despite its strong points, its recent returns have been below benchmark. Aside from this, MSCI Philippines has a rather high expense ratio of 0.58%.

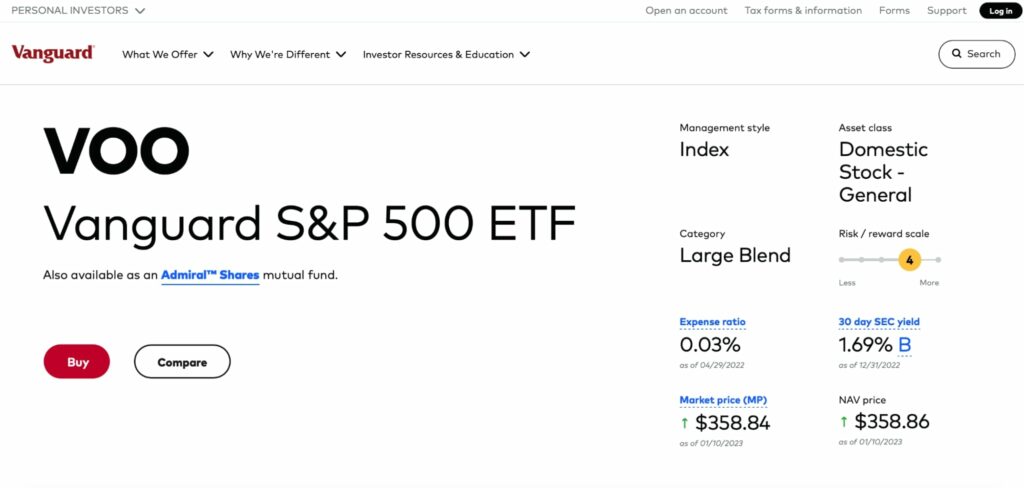

5. Vanguard S&P 500 ETF (VOO)

| Liquidity | 5/5 |

| Trading Activity | 4/5 |

| Management Cost | 5/5 |

| Investment Risk | 5/5 |

Pros

- Passively-managed, free trading

- Cuts out the middleman

- Quarterly dividends

- Remarkably low expense ratio of 0.03%

- Low risk

Cons

- Limited to US stocks

- Low chance of high returns

If your main goal with investing in ETFs is diversifying your portfolio, Vanguard should be high up on your priority list. VOO reflects the S&P 500 Index, also known as the 500 largest companies in the United States.

This covers an entire slew of industries, from long standing corporations that have stood the test of time to the newest and most promising multi-billion dollar tech companies on the block.

Vanguard uses a passively-managed, free trading business strategy that cuts out the middleman. We like this because when you invest with Vanguard S&P 500, you’re technically an owner and not just a shareholder of the stocks you purchase.

As an investor you can enjoy quarterly dividends. Among all the ETFs we reviewed, Vanguard offers a remarkably low expense ratio of 0.03%.

There’s also a lower risk to investing in S&P because they are historically capable of recovering from slumps, which is a major plus for us long-term investors.

If we were to nitpick investing in VOO, it’s that you’re limited to U.S. stocks. Moreover, since your investment portfolio is full of blue-chip companies, this is a more conservative investment where there is a low chance of high returns.

If you wish to trade and invest in VOO, you can use the eToro mobile platform.